Bad Debts Recovered Journal Entry

A soap manufacturer has already created a batch of soaps to dispatch to different points of sale. It is because the initial transaction gets treated as an expense.

Journal Entries For Bad Debts And Bad Debts Recovered Youtube

Journal entry for the actual bad debt would be.

. What is the journal entry for Bad Debt Recovery. What is the Journal entry for bad debts recovered. The full amount should be written off to the Income statement of the related period or against the provision for doubtful debts.

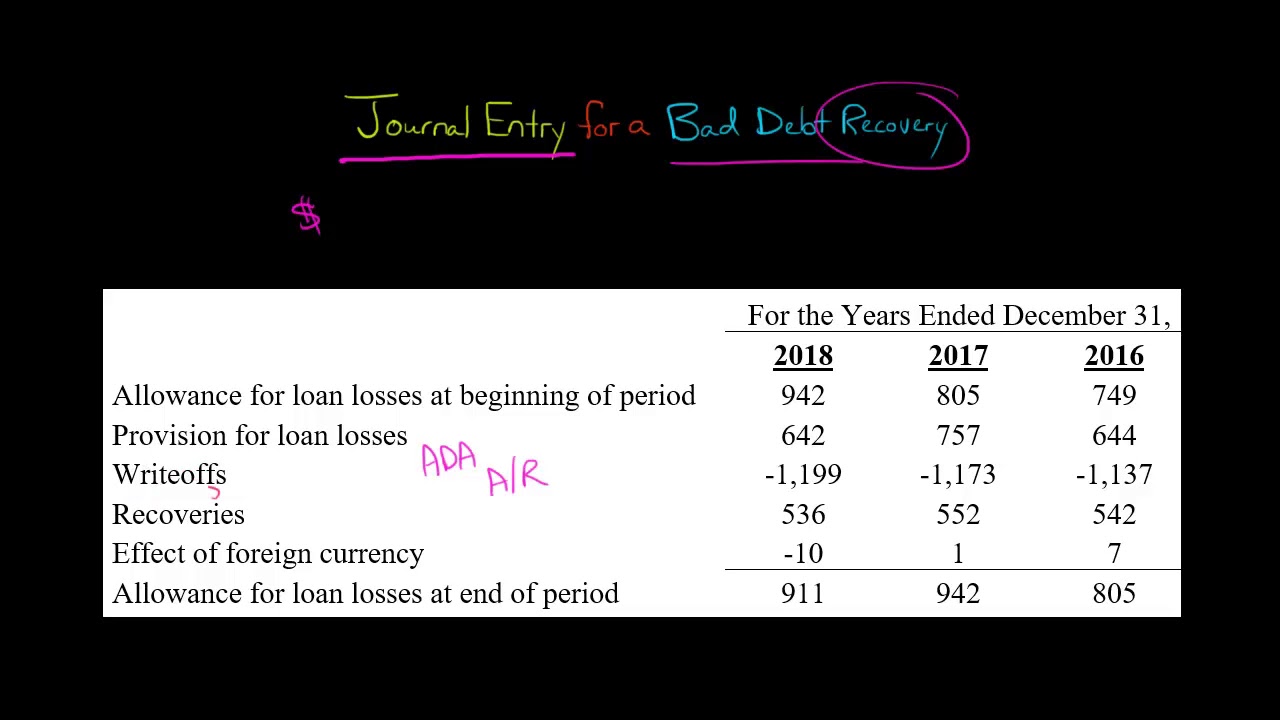

Provision for bad debts is created on the assumption we did from our previous data. It is usually determined by past experience and anticipated credit policy. The two methods used in estimating bad debt expense are 1 Percentage of sales and 2 Percentage of receivables.

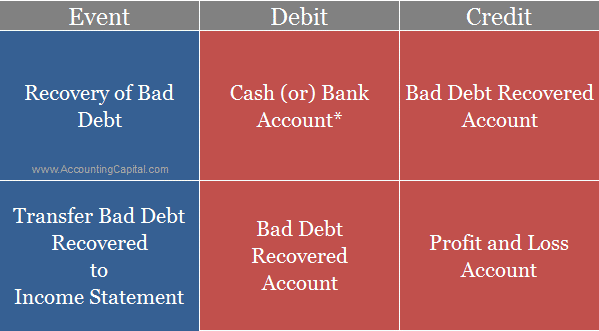

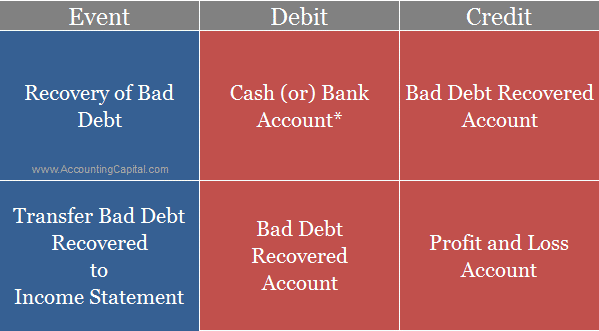

We adjustment entry of need to pass at the end of the accounting year. So we will debit the bank account asset account and Credit to the bad debts recovery account income account in the journal entry. Allowance method Direct write-off method Allowance method Under the allowance method the company records the journal entry for bad debt expense by debiting bad debt expense and crediting allowance for doubtful accounts.

When a bad debt is recovered two journal entries are required 1 To reverse the write off of bad debt Account Receivable Dr To Provision for bad debts 2To record the collection of cash CashBank Dr To Account Receivable Srishti. In this accounting lesson we explain what bad debt and bad debt recovered are. Bad debt recovery means you need to create new journal entries in your books.

You can either use the allowance method or direct write-off method. Rajeev becomes insolvent and nothing recover from his estate Year 2. Pass Journal Entry In the Books Of Mr.

Reinstate the Accounts Receivable Balance In order to account for the bad debt recovery it is first necessary to reinstate the accounts receivable balance for the amount received. Since the debtors account occurs or increases on the debit side if we want to decrease it. The journal entry to record the bad debt recovered is debit cash and credit other income.

One is able to recover VAT on doubtful debts after they have been outstanding for 6 months but less than 4 years and 6 months old as long as you have accounted for the VAT in the first instance. The journal entry for bad debts is as follows. Partially or fully irrecoverable debts are called bad debts.

The accounting records will show the following bookkeeping entries for the bad debt recovery. Here 2 of 500000 will be 10000 so it is assumed that 10000 is irrecoverable. Your books must reflect the recovered amount.

This is recorded with a journal entry for recovery of debts turned bad. As seen in the above journal entries the direct write-off method can potentially misstate the bad debts expense between the periods because a write-off from previous period may results in a gain in current period if the receivable is eventually recovered. Bad debts expense Credit.

Bad debt recovery represents an income for companies. A sum of 2000 earlier written as bad debts is now recovered. The journal entry is debiting the 5000 to the bad debt expense account and crediting the same amount to the accounts receivable.

Summary for Bad Debts Recovered Journal entry Bad debts recovered entry is to record the income receivable from already recorded bad debt. Bad debts recover and its journal entry When in one accounting year we declared that the money from the debtor is bad debts but in the next accounting year the money is recovered that money become bad debts recover. Percentage of Sales Percentage of sales involves determining what percentage of net credit sales or total credit sales is uncollectible.

Accounting and journal entry for recording bad debts involves two accounts Bad Debts Account Debtors Account Debtors Name. While accounting for bdebts it is treated as a loss to business and reduces the total accounts receivable. When a company writes off a debtor balance as bad it uses the following journal entry.

Bad Debt Expense Journal Entry We may come across two methods of journal entry for bad debt expense as below. The main reason that it is recorded as the other income since it is not the main source of income that the company generates from its normal business activities. Bad Debts Recovered Journal entry Bad Debts- When the goods are sold to a customer on credit and if the amount becomes irrecoverable due to his insolvency or for some other reason the amount not recovered is.

Bad Debts Recovered. Debtors control account asset What this journal entry means is that we are recording the loss of the money we expected to get in in the future from Mr. When the amount that is earlier written as bad debts is now recovered it is called bad debts recovered.

Given the high consumption of soaps it reorders raw materials to start manufacturing the next lot. We show how to record a bad debt recovered journal entry and how to account f. Bad Debt Recovery Bookkeeping Entries Explained Debit.

Now we have to create provisions for bad debts 5 on debtors. So its a recovery from a loss asset. To understand inventory or stock management in a better way let us consider the following example s.

Understand it with example Year 1 Sold good to Rajeev Rs 15000. Bad debt is a loss for the business and it is transferred to the income statement to adjust against the current periods income. This transaction will remove the 5000 of the accounts receivable from the balance sheet as the company does not expect to collect from the customer.

How you create a bad debt recovery journal entry depends on your original bad debt journal entry.

Bad Debt Recovery Financiopedia

Journal Entry For A Bad Debt Recovery Youtube

Journal Entry For Recovery Of Bad Debts Accountingcapital

Journal Entry For Bad Debts And Bad Debts Recovered Geeksforgeeks

No comments for "Bad Debts Recovered Journal Entry"

Post a Comment